Fingertip vs. Xero: Why Fingertip is the Best Invoicing System for Freelancers and Entrepreneurs

Alright alright. So, you've heard about our competitors. Here's why you should stick with us.

For freelancers and small businesses, managing invoices with an efficient invoicing system is key to maintaining cash flow and smooth operations.

Xero is a popular choice for those seeking a full-fledged accounting platform, but it often includes features beyond what freelancers and small businesses need for simple invoicing.

Fingertip, on the other hand, provides a streamlined, user-friendly invoicing system that also includes website building, appointment scheduling, and more.

If you need to track finances in more detail, Fingertip integrates with Xero, offering a comprehensive solution.

Fingertip: A Simple, All-in-One Business Platform

Fingertip is designed to be a simple, effective tool for freelancers and small business owners who need more than just invoicing.

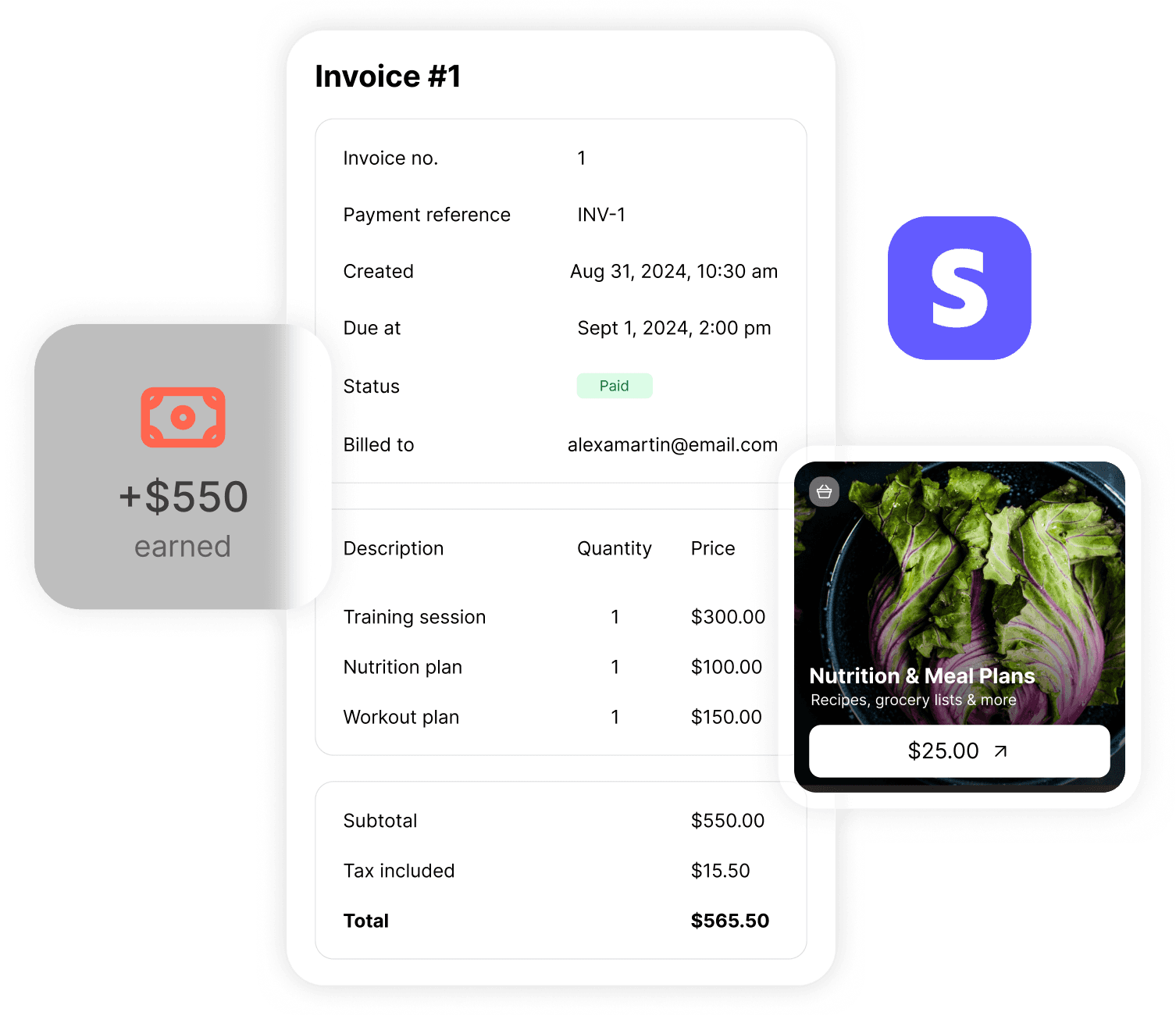

With Fingertip, you can create and customise professional invoices, track payments, and send automated payment reminders.

The platform also includes additional business management tools like website building and appointment scheduling.

For those who need a more detailed accounting solution, Fingertip integrates smoothly with Xero, allowing you to track your invoicing within your full financial ecosystem.

Key Invoicing Features in Fingertip:

• Customisable Invoices: Easily create branded invoices with your logo and business details.

• Automated Reminders: Automate payment reminders for overdue invoices, so you don’t have to follow up manually.

• Payment Flexibility: Accept payments through PayPal, Stripe, or credit cards, offering multiple options for clients to settle invoices.

• Xero Integration: If you need more detailed financial tracking, you can integrate Fingertip with Xero, syncing your invoicing data for full accounting visibility.

Fingertip provides everything you need to manage your business in one place, from invoicing to client management, without the complexities of a full accounting platform like Xero.

Xero: Comprehensive Accounting with Robust Invoicing

Xero is a leading cloud-based accounting platform that offers a wide range of features beyond invoicing, including expense tracking, payroll, and tax reporting.

While its invoicing tools are powerful, Xero’s primary focus is on providing full financial management, which may be overkill for freelancers or small businesses simply looking to send invoices and get paid quickly.

Xero’s Invoicing Features Include:

• Custom Invoices: Create professional, branded invoices with custom fields and templates.

• Automatic Payment Reminders: Send reminders to clients for unpaid invoices and set late payment fees.

• Expense and Time Tracking: Track your expenses and time alongside your invoices, ideal for businesses needing full financial visibility.

• Real-Time Financial Reporting: Xero offers detailed financial reports such as profit and loss statements and balance sheets, making it a comprehensive financial management tool.

• Multi-Currency Invoices: Ideal for businesses with international clients, allowing you to send invoices in various currencies.

While Xero’s invoicing is robust, it’s more suited to businesses that require comprehensive accounting features.

If invoicing is your main focus, Fingertip provides a more straightforward, user-friendly solution that doesn’t overwhelm you with accounting tools you may not need.

Cost Comparison: Fingertip Offers Greater Value for Freelancers and Small Businesses

Fingertip is designed to be cost-effective, with the Pro Plan available for just $16 AUD per month. This plan includes invoicing, website building, and appointment scheduling, offering a complete package for managing your small business.

If you need more detailed accounting, Fingertip’s integration with Xero gives you the option to sync your data while keeping Fingertip as your main business management tool.

Xero is priced higher, starting at £14/month for the Starter Plan, which includes basic invoicing and reconciliation for a limited number of transactions.

To unlock more features, such as bulk reconciliation and detailed financial reports, you’d need the Standard Plan at £28/month, which is more expensive than Fingertip’s all-inclusive offering.

For freelancers and small business owners who want a more comprehensive platform without the cost and complexity of full accounting software, Fingertip offers better value, while still allowing integration with Xero for those who need it.

Ease of Use: Fingertip is Simpler, Xero is More Complex

Fingertip is built with simplicity in mind. Its user-friendly interface allows you to create and send invoices in minutes, set up recurring payments, and manage all aspects of your business—whether it’s scheduling appointments or building a website easily—from one dashboard.

This makes it ideal for freelancers and small business owners who need to manage their day-to-day operations without worrying about the intricacies of accounting.

Xero, while user-friendly for accounting professionals, comes with more layers of complexity due to its accounting focus. For freelancers or small businesses who only need invoicing, Xero’s additional features—like bank reconciliation, financial reporting, and tax management—can feel excessive and harder to navigate.

Why Fingertip is the Better Choice for Freelancers and Small Businesses

• Fingertip is ideal for freelancers and small business owners who need an easy-to-use, all-in-one platform for invoicing, client management, and website building.

It allows you to manage your business without dealing with complex accounting tools, but if you need them, Fingertip integrates with Xero to give you more detailed financial tracking.

• Xero is perfect for businesses that require comprehensive accounting and financial management.

However, if your primary goal is to send invoices and manage client payments, Fingertip offers a more streamlined and cost-effective solution.

Conclusion: Fingertip vs. Xero – The Smarter Choice for Invoicing and More

While Xero is a robust accounting platform with excellent invoicing capabilities, Fingertip is the smarter choice for freelancers and small business owners who want an easy-to-use solution for invoicing and business management.

With Fingertip, you get all the tools you need to run your business—without the complexities of a full accounting system—while still having the option to integrate with Xero for advanced financial tracking.

To learn more about how Fingertip can help you simplify your invoicing and grow your business, visit Fingertip Invoicing.